Sixth Form 16-19 Bursary Fund

Each year Sixth Form students can apply for a bursary to help with education-related costs if they’re aged 16 to 19 to pay for things like:

- Clothing, books and other equipment for your course

- Transport to and from school

- Daily Meal Allowance to use in the school canteen

Students must meet certain criteria and have an actual financial need for funding support. Please refer to the 16-19 Bursary Fund Policy and Overview using the links below for full details.

16-19 Bursary Fund Policy 2024/25

16-19 Bursary Fund Overview 2024/25

How to Apply:

Applications need to be submitted through your existing Admissions+ account.

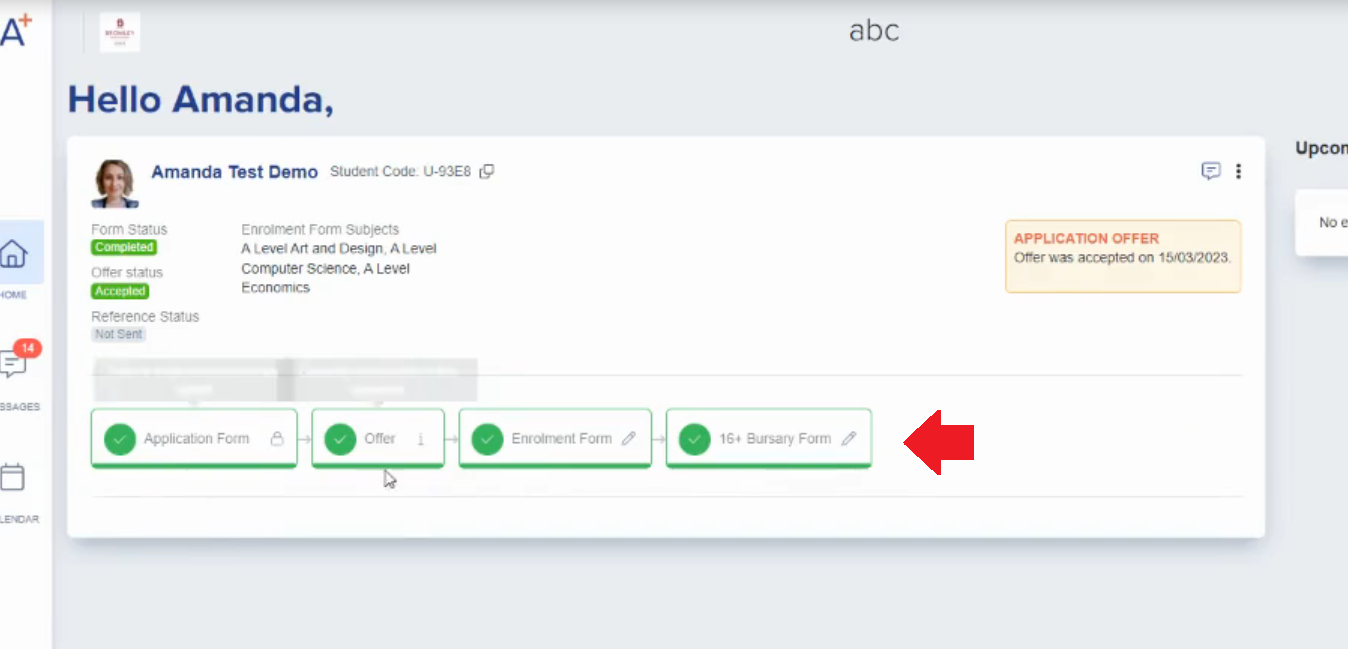

Log into your existing Admissions+ account and select the 16+ Bursary Form tile, see the screenshot below:

You can also follow the link below which will take you directly to the 16+ Bursary log in screen. On the log in screen you will need to use your existing Admissions+ login details for access.

https://prioryacademiesbursary.applicaa.com/

If you have any further questions or need help completing an application form; please email the Finance Team at 1619bursary@prioryacademies.co.uk